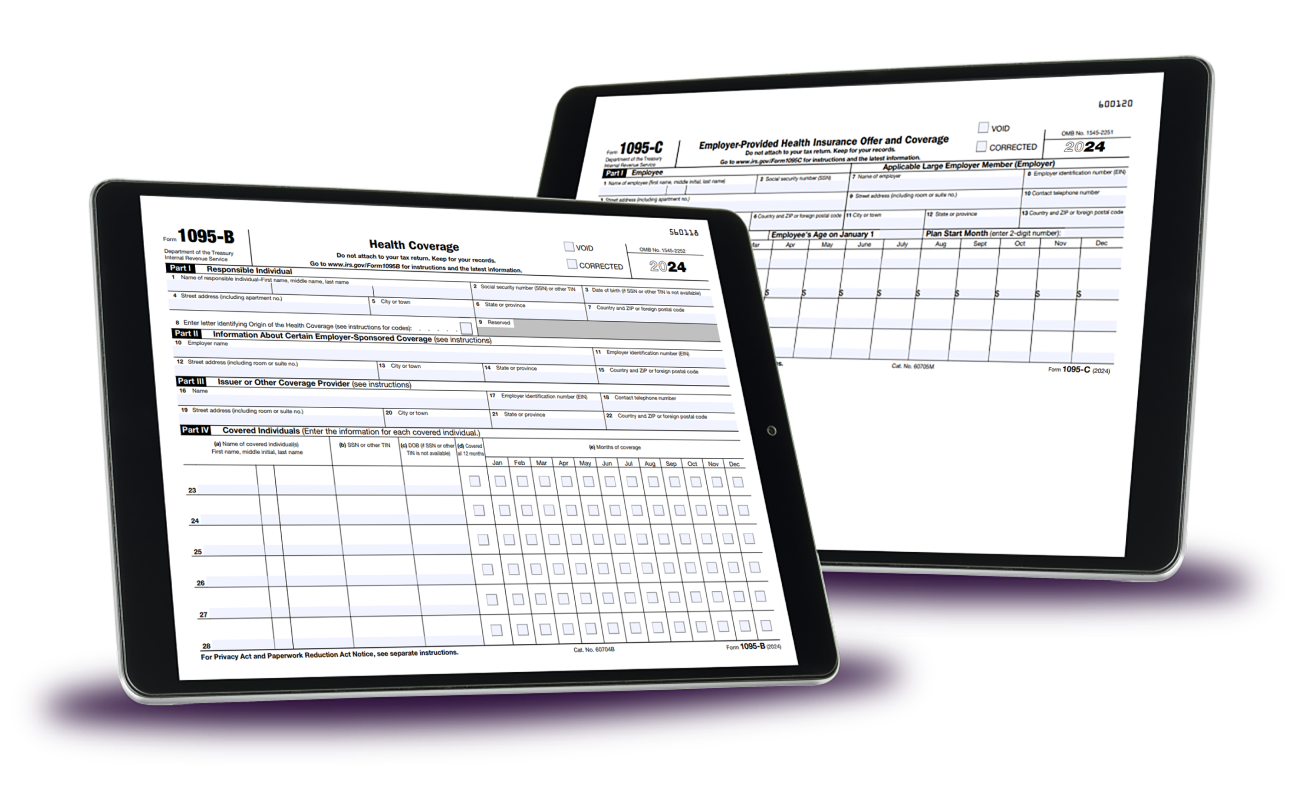

IRS Form 1095-B/1095-C Filing Deadlines for the 2024 Tax Year

Recipient Copy Deadline

March 03, 2025

Paper Filing Deadline

February 28, 2025

E-Filing Deadline

March 31, 2025

If the deadline falls on a Saturday, Sunday, or federal holiday, the next business day becomes the deadline.

Complete your 1095-C Filing / 1095-B Filing before the deadline to avoid penalties.

Information Required to

File 1095-B/1095-C Online

The following information is required to file Form 1095-B

- Employer / Coverage Provider information: Name, EIN, Address, and Contact

- Individual Information: Name, Social Security Number, and Address

- Information about the individuals covered

Visit: https://www.taxbandits.com/aca-forms/file-1095-b-online/ to learn more about Form 1095-B online filing Requirements.

The following information is required to file Form 1095-C

- Employer information: Name, EIN, Address, and Contact

- Employee Information: Name, Social Security Number, and Address

- Offer/Coverage Details: ACA Codes, and amount

- Information about the individuals covered

Visit: https://www.taxbandits.com/aca-forms/file-1095-c-online/ to learn more about Form 1095-C online filing Requirements.

Choose TaxBandits to file your 1095-B/1095-C Online

TaxBandits is an experienced e-file provider that simplifies the filing process of ACA Forms. We provide detailed filing instructions throughout the process to assist employers with accurate filing.

Eliminate stress from your filing process with these time-saving features:

Direct State Filings

Some states have mandated filing ACA 1095 Forms with their agencies in addition to filing with the IRS. Our software supports direct filing with the required states.

Print & Postal Mailing

Health Coverage providers are responsible for distributing copies of the ACA forms to their recipients. If you choose our printing and mailing services, our team will handle the distribution of these copies before the deadline.

Bulk Upload

Are you required to file a high volume of forms?

We offer options for you to upload and file all your ACA forms in bulk using our bulk upload template or your own.

Online Access Portal

You can provide your recipients access to view and download their 1095-B/1095-C forms as needed from our secure online access portal. If any corrections are filed, the recipient can access these as well.

Our Live Customer Support Team is here to assist with your ACA Form 1095-B / 1095-C Filing. If you find that you need assistance during the e-filing process, our live customer support team is available by email, phone, and chat.

How to file Form 1095-B/1095-C Online?

Follow this simple process to start filing Forms 1095-B / 1095-C with TaxBandits

01

Enter the employer/employee basic details

02

Choose the Form 1095-B / 1095-C

03

Enter the details and Review your form

04

Transmit to the IRS and State

05

Deliver copies to recipients (online/postal)

Are you ready to File 1095-B Online / File 1095-C Online with us?

Form 1095 Extensions

If you need more time to file Form 1095-B or 1095-C, you can request an extension from the IRS using the extension Form 8809. Once the IRS accepts this form, you will be granted an additional 30 days to file your returns. E-filing Form 8809 is a simple process that can be completed in minutes.

Form 1095 Corrections

It is not uncommon for the IRS to reject forms, if this happens, there is no need to worry. We will notify you by email, you can then correct your 1095 form and retransmit it to the IRS. You can easily file a transmittal Form 1094 with your corrected form and issue a correction for the recipient.

State Filing of Affordable Care

Act (ACA) Forms

After congress eliminated the federal mandate penalty in 2018, many states implemented their own individual mandates.

Currently, the below states have Individual Mandates

The following states are also considering individual mandate

ACAwise, A Full-Service ACA Reporting Solution Provider

Are you seeking a full-service solution that includes forms generated with ACA codes as well as Federal and State filing?

Contact our Sister Product ACAwise, a full-service ACA reporting solution that handles every aspect of ACA Form 1095-B/C filing on your behalf.

Frequently Asked Questions on

Form 1095

Who needs to file Form 1095-C?

Form 1095-C , the Employer-Provided Health Insurance Offer and Coverage, is filed by Applicable Large Employers (Employers with 50 or more employees) with the IRS.

This form is used to report detailed information about the health coverage that the ALE offered to its eligible employees.

These details are used by the IRS to determine:

- Whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H.

- The employee's eligibility for a premium tax credit.

Visit https://www.taxbandits.com/aca-forms/what-is-form-1095-c/ for more information about Form 1095-C.

Who must file Form 1095-B?

Form 1095-B is used for reporting information about individuals that are enrolled in minimum essential coverage.

It must be filed by,

- Anyone who provides minimum essential coverage to an individual during a calendar year.

- Government employers that offer employer-sponsored, self-insured health coverage to non-employees.

- Small employers who sponsor self-insured group health plans.

Visit https://www.taxbandits.com/aca-forms/what-is-form-1095-b/ to learn more about Form 1095-B.

Are there any IRS updates to Form 1095-C for the 2024 Tax Year?

As per the ACA Final Forms released by the IRS, there are no recent updates to 1095-C Form for the 2024 Tax year.

Click here to learn more about Form 1095-B and 1095-C Changes for 2024

What are the reasons that employers receive IRS penalties?

The IRS can impose penalties on employers for the following reasons:

- Late filing

- Filing with Incorrect information

- Incomplete filing

Generally, the ACA penalty imposed for these reasons is $330/return with the total penalty for a calendar year not exceeding $3,987,000. To avoid these penalties E-File 1095-C / E-File 1095-B and get instant approval from the IRS.

Click here for more information about ACA Penalties.

Helpful Resources

Form 1095-C Instructions

Learn more

Form 1095-B Instructions

Learn more

ACA Reporting Requirements

Learn moreE-File Form 1095-B/1095-C Accurately with our Software

Contact Us

If you need assistance during the 1095 e-filing process, don’t hesitate to reach out to your live customer support team by phone, email, or chat.